Internal Controls for the Acquisition and Payment Cycle

All equipment items are either owned by or in the. The bank reconciliation should also include a review of the bank.

Fixed Asset Management The Main Concepts Fixed Asset Consulting Business Asset Management

Identify the internal controls for the acquisition and payment cycle.

. Smart companies require their purchasing agents to use a list of approved vendors and review vendors on a regular basis. The stronger internal controls the company has in place the less likely it is that there are errors or fraud in the purchasing system. Link each internal control to a risk risks for each of the functions Jackson Stent 2016.

Approved purchase orders are required for all acquisitions of goods. Against balances in the purchase ledger by an independent official. Approved purchase orders are required for all acquisitions of goods2.

13-26 Objectives 13-1 13-4 13-5 The following are independent internal controls commonly found in the acquisition and payment cycle. The fact is that management at all. The auditor examines payments to vendors following year end and then reviews any open accounts payable files.

Identify where these internal. Goods invoice authorization and payment routines. Understand Internal Control The auditor gains an understanding of internal control for the acquisition and payment cycle by studying the clients flowcharts preparing internal control questionnaires and performing walk-through.

Inventorial equipment has an acquisition cost of 5000 or more and must be tracked as property through CAMS Campus Asset Management System and through UC San Diegos financial system. The acquisition and payment cycle is a computerized process that is integrated with supply chain management is the management and control of materials in the logistics process from the acquisition of raw materials to the delivery of finished products to the end user. 221 Internal controls for purchase and payment cycle is mainly concerned about the following aspects.

An internal control is used to prevent cash disbursement paperwork from being submitted a second time in which the official signing the check compares the check to the documents. Classify the procedure as primarily a substantive test a test of controls or both. Checks are mailed by the owner or manager or a person under her supervision after signing.

Describe the business functions and the related documents and records in the acquisition and payment cycle. Purchase ledger and suppliers. Managers often think of internal controls as the purview and responsibility of accountants and auditors.

The bank reconciliation should be completed in a timely manner by someone who is independent of the cash disbursement process. Prenumbered receiving reports are prepared as support for acquisitions and numeri- cally accounted for. All supporting documents are cancelled after checks are signed or electronic funds transfers are approved.

The following internal controls for the acquisition and payment cycle were selected from a standard internal control questionnaire. Prenumbered receiving reports are prepared as support for acquisitions and numeri-cally accounted for3. Its easy for things to go wrong in a companys acquisition and payment cycle.

Types of Audit Tests for the Acquisition and Payment Cycle Accounts Payable Payments Expenses Audited by TOC STOT and AP Audited by TOC STOT and AP Ending balance Audited by AP and TDB TOC STOT AP TDB Cash in Bank Acquisition Expenses Ending balance Audited by AP Sufficient appropriate evidence per GAAS 2008 Prentice Hall. Keep your resources safe and reports reliable by focusing on the following key internal control practices. Methodology for Designing Controls and Substantive Tests Understand internal control acquisitions and cash disbursements Assess planned control risk acquisitions and cash disbursements Determine extent of testing controls Audit procedures Sample size Items to select Timing Design tests of controls and substantive tests of transactions.

Discuss two risks from the attached Financial Statements that represent issues that warrant additional attention. Reconcile bank accounts in a timely manner. Understand internal control and design and perform tests of controls and substantive tests of transactions for the acquisition and payment cycle.

Dates on receiving reports are compared. 119 1113 Risks and internal controls become more logical and therefore easier to remember in the exam Remember the What on what why and by whom Downloaded by GEOFREY GEOFFREY. Acquisitions and Payments Cycle When you study risks and internal controls do the following.

The following internal controls for the acquisition and payment cycle were selected from a standard internal control questionnaire. Which of the following statements is false regarding obtaining evidence about internal control operating effectiveness in the acquisition and payment cycle. Identify the objective of the procedure or the audit assertion being tested.

Presence of supporting. Identify the internal controls for the acquisition and payment cycle 1. A Proper authorization of purchases.

Evidence of proper payment is not necessary for each purchase and payment but is necessary for those that are material. Ensure Controls Are in Place. I A payables ledger control account should be maintained and regularly checked.

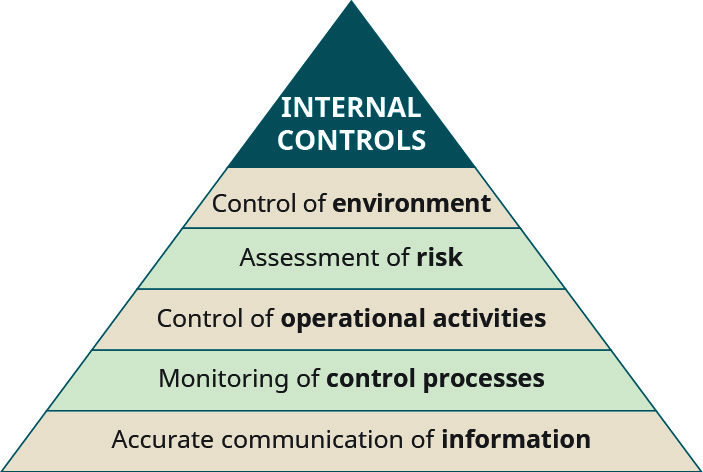

Tests of controls and substantive tests of transactions for the acquisition and payment cycle are divided into 2 broad areas. Transactions in the acquisition and payment cycle. Internal controls are the mechanisms rules and procedures implemented by a company to ensure the integrity of financial and accounting information promote accountability and prevent fraud.

Each control is to be considered independently. Most important the call back cannot go to any individual who is able to initiate a wire transfer. Operating effectively with appropriate segregation of duties application of sections 32 33 and 34 of the FAA by authorized officers.

The revision of the internal control monitoring strategy based on a fulsome risk assessment including the extent and timing of testing for the Purchasing Payables and Payments Process. Ii Payables ledger records should be kept by persons independent of the receiving of. Final assessment opportunity 2016.

The following internal controls for the acquisition and payment 1. This reduces the risk of fraud and kickbacks for purchases. The following internal controls for the acquisition and payment cycle were selected from a standard internal control questionnaire1.

Implementing the Five Key Internal Controls Purpose Internal controls are processes put into place by management to help an organization operate efficiently and effectively to achieve its objectives. Before a check is prepared to pay for acquisitions by the accounts payable department the related purchase order and receiving report are attached to the vendors invoice being paid.

Purchasing Procurement Process Flow Chart Process Flow Chart Process Flow Flow Chart

Define And Explain Internal Controls And Their Purpose Within An Organization Principles Of Accounting Volume 1 Financial Accounting

Acquisition And Payment Cycle The Auditor S Role In The Payables

Iasset Integra Micro Systems Document Management System Asset Management Resource Management

Comments

Post a Comment